2020年,新冠肺炎疫情肆虐全球,世界经济陷入停摆。这是一场史无前例的全球危机,全球经济正面临着需求供给双重冲击,任何经济体都难以独善其身。值此变局关键时刻,本站财经联合上海交通大学上海高级金融学院、北京大学国家发展研究院以“全球经济与政策选择”为主题,邀请政商学企界嘉宾通过线上形式解析全球经济面临的机遇与挑战。

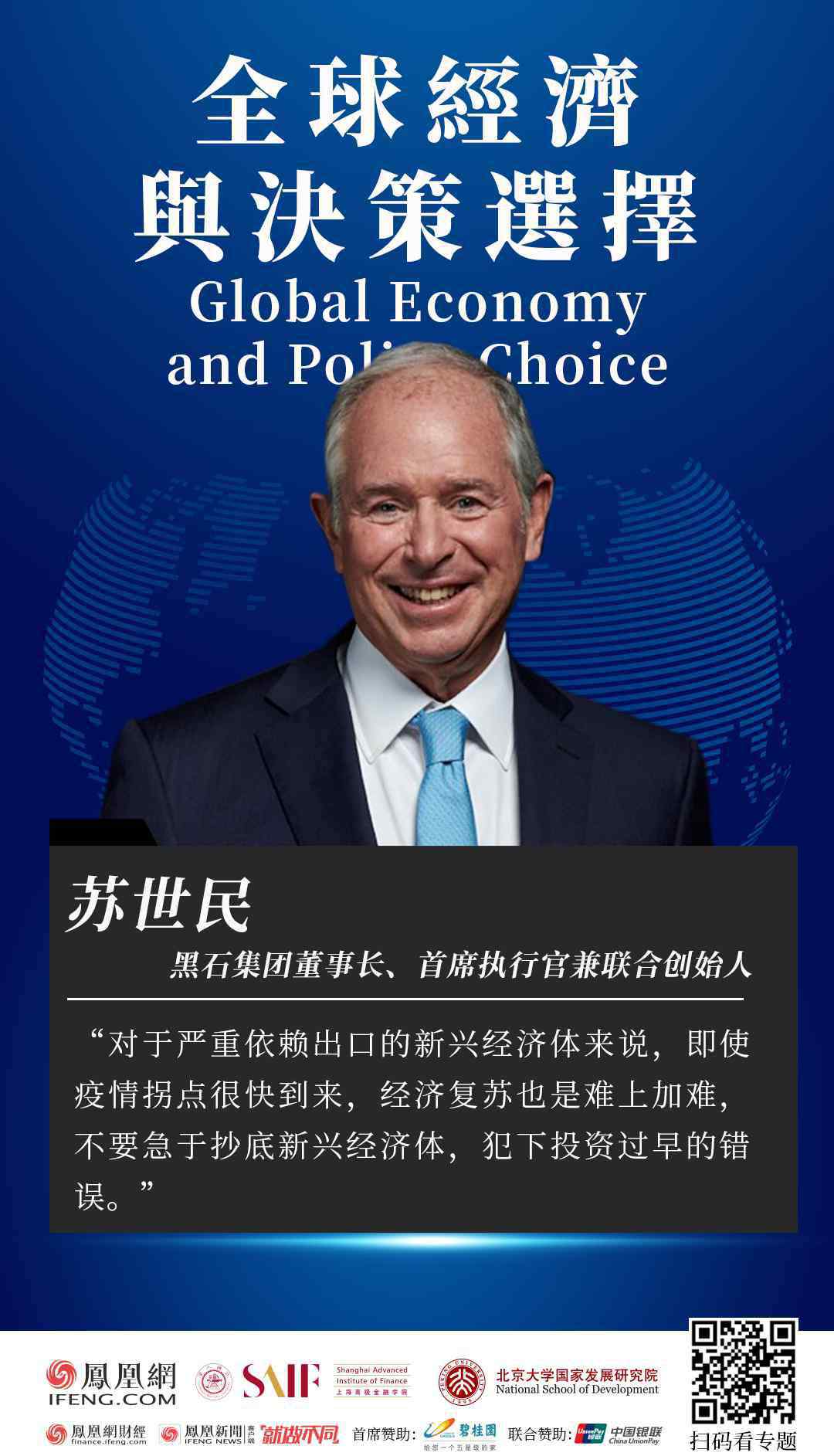

在5月7日的凤凰连线中,黑石集团的董事长、首席执行官和联合创始人,畅销书《苏世民:我的经验与教训》的作者史蒂夫·施瓦茨曼对疫情对全球经济的影响作出深度剖析。截至2019年末,全球私募巨头黑石集团管理的资产价值高达5710亿美元,作为黑石集团董事长、首席执行官和联合创始人的苏世民也被称为“华尔街私募之王”,他曾经历过7次大规模的经济衰退和市场下滑,每次都能危中掘金的他是如何做到的?这次又能看到疫情下的哪些投资机会?

全球范围来看,新冠疫情影响是前所未有的,病毒导致了接近1930年代大萧条时的高失业率,苏世民看来,与从前金融危机时期不同的是,疫情下的失业更是主动权衡后的结果,为了保护全世界的公民免受新冠病毒肆虐的侵害,经济不得不为健康做出了让步,停滞的生产导致高失业率的发生。

影响地区来看,苏世民认为“中国很可能是恢复得最快的经济体”,不仅因为中国是第一个应对这个问题的国家,并且中国庞大的消费市场和中国的体制的优势也使得中国的经济恢复加速进行。另外,对于严重依赖出口的新兴经济体来说,即使疫情拐点很快到来,经济复苏也是难上加难,因此苏世民提醒不要急于抄底新兴经济体,犯下投资过早的错误。

就行业而言,苏世民分析,石油和天然气行业因为需求的锐减陷入困境,餐饮、旅游和零售行业受到疫情的冲击,但医疗保健行业也蕴含着巨大的投资机会,与计算机科技创新结合的领域充满想象。

“中国的亿万富翁比世界上任何地方都多,人们能够非常努力工作且坚持不懈,这是中国能屡创奇迹的原因之一。”苏世民高度评价中国,他还鼓励中国读者大胆创新:如果你有一个绝妙的想法并且知道如何付诸实践,你就一定有魅力吸引资本,可以创造出一些美妙的奇迹。

以下为演讲实录:

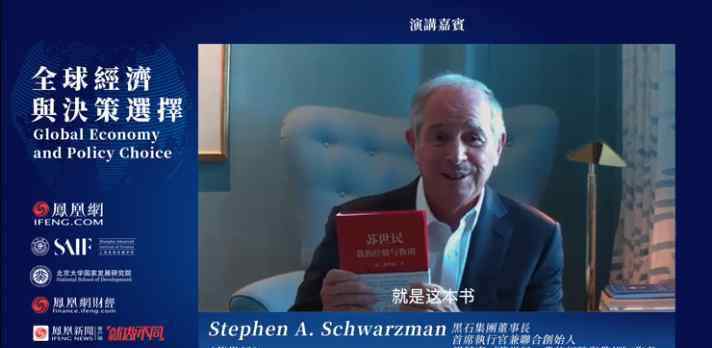

I"m Steve Schwarzman, Chairman, CEO and Co-Founder of Blackstone. I"m also the bestselling author of What It Takes: Lessons in the Pursuit of Excellence.

我是史蒂夫·施瓦茨曼,黑石集团的董事长、首席执行官和联合创始人,也是畅销书《苏世民:我的经验与教训》的作者。

Here is a copy of the book. It"s number one in China and a bestseller in the United States and around the rest of the world. It"s great to be with you here today.

这本书在中国的图书榜排名第一,在美国和世界其他地区也都是畅销书。我很高兴今天有这个机会和大家连线。

病毒引发高失业率:不是意外,为了健康不得不如此

Question: COVID-19 is putting the global economy into a tailspin. Many countries are heading for very sudden and unprecedented recessions. Do you expect to see major changes in a post-pandemic economy?

问:新冠疫情正在让全球经济陷入混乱,许多国家正面临非常突然和前所未有的衰退,您认为病毒大流行后的经济会有重大变化吗?

The virus and its impact is absolutely unprecedented. In the last hundred years, no one knew anything even vaguely like this will have unemployment levels that will be close to the Great Depression of the 1930s. And it was all done voluntarily.

这次新冠疫情及其影响绝对是前所未有的,在过去的一百年里没有人想象得到,如今病毒也会导致接近1930年代大萧条时期的高失业率,而今天的这一切可以说是主动权衡的结果。

With the Depression and the other major downturns like the Global Financial Crisis in 2008 and 2009 those were accidents, this was on purpose. And it was done to protect citizens all over the world from the spread of COVID-19. And that was a very important thing to do.

与大萧条时期和其他重大衰退这些是意外事件导致的失业率飙升不同,这次是有意为之,我们当前所做的一切都是为了保护全世界的公民免受新冠病毒肆虐的侵害,这是至关重要的。

On the other hand, it has left the economies of the world in an exceptionally difficult position – very high unemployment, a lot of businesses closed voluntarily or involuntary, businesses have collapsed. How you restart that economy around the world is an issue that we"re just starting to face.

虽然另一方面,这使得世界经济陷入异常困难的境地——极高的失业率,许多企业自愿或非自愿地关闭甚至破产,因此,如何在全球范围内重启经济是我们刚刚开始面临的问题。

What"s happened in almost every economy is – when this downturn was happening because people were staying in their own homes or their own apartments – governments in almost every country have put a lot of money into the economy to keep it going in effect, even if it"s not going to supply money to the people in their countries, so that they won"t have their savings severely diminished.

发生在每个国家的情况相似,因为人们都不得不待在家中,导致经济发展一度停滞。即便是没有直接向国民发现金,几乎每个国家的政府都投入了大量的资金以保持经济的有效运行,所以居民储蓄也不至于严重减少。

These efforts are quite good in the United States but imperfect – they can"t reach almost everyone with the right amount of money. So I think what will happen is that consumers will be slow to respond to going back to work. Once you"ve had your savings repaired, you"re less likely to spend and it"ll take a while before all of these economies get to where they used to be.

这些举措在美国还比较有效的,但还不够完善——因为他们不可能给到每个人充足的钱。所以我认为,消费者对重新开始工作的反应将是缓慢的。一旦储蓄得到恢复,你就不太可能花钱了,而且需要一段时间,经济才能恢复到以前的水平。

Different consultants have different points of view on each country. China will most likely be the most rapidly returning economy for a lot of different reasons.

不同的专家对每个国家有不同的看法,但中国很可能是恢复得最快的经济体,有如下几个理由:

First, China was the first to deal with this issue.

首先,中国是第一个应对这个问题的国家。

Secondly, the nature of the Chinese consumer and Chinese system has people going to work quite quickly. Factory production is up a lot. They just opened traveling so you can see an instant response with airline travel and train travel.

其次,中国消费者和中国的体制的特性让人们很快就能开始工作。工厂的生产增加了很多。旅游业刚刚放开,所以你可以看到航空旅行和火车旅行的即时反应。

But it"s not back instantaneously to where it started and that"s normal to expect. Most people would like it to be faster, but it"s not going to be as fast as an ideal case. But I think in China, it"s going to get back quicker to those kinds of levels and they"ll be different things going on in those economies.

但它不会马上恢复到最初的水平,这很正常。大多数人希望它更快,但情况未必总能如愿。但我认为在中国,恢复到正常的水平会比其他经济体更迅速。

There"ll be more of an emphasis on computer science and in distance type of communications. Much like I"m being recorded now on something called Zoom. That"s normal now. Those of us who are a little older didn"t necessarily use all that kind of technology, but now, that"s what we do.

未来,我们将会更重视调计算机科学和远程通信,就像我现在被一种叫做Zoom的软件录制下来,现在这样做很普遍。我们这些年纪稍大一点的人不一定会使用这些技术,但现在我们也做到了。

There"s going to be retraining, jobs are going to shift. They"ll still be leisure activities. People will want to go to theme parks. But for a while, they"re going to be concerned about whether they"ll get the virus from somebody.

人们会被重新培训,工作岗位将会转移。虽然仍然会有娱乐活动,人们会想去主题公园。但在一段时间内,人们仍然会担心是否会从别人那里感染病毒。

Less concerned in China because the numbers have been suppressed in terms of communicable nature and there are very few people who are getting newly infected with the virus. So there"s a lot of reason, I think, to be optimistic about China"s prospects.

在中国,人们的担心有所减少。因为就传染性而言,感染人数受到了抑制,而且新感染该病毒的人非常少。因此,我认为有很多理由对中国的前景感到乐观。

行业影响分化:能源、零售受重创,医疗保健蕴含大机会

Question: Few industries can avoid being impacted. In your opinion, which industry will suffer most? Who will be the winners in a post-pandemic economy?

问:很少有行业能够避免受到影响。在你看来,哪个行业受影响最大?在病毒大流行后的经济中,谁将是赢家?

I think in terms of suffering the most, the oil and gas business is at the moment. The reason for that is, there"s roughly on a global basis about a hundred billion barrels a year consumed and the amount that"s produced is very similar. What"s happened as a result of people staying at home and factories shutting is that the demand for oil basically is going down at least twenty five million barrels. So there"s twenty five million of overproduction, which drives profits down and the consumption of oil just isn"t enough.

我认为,就受影响最严重的行业而言,石油和天然气行业目前处于困境。因为全球每年大约消耗1000亿桶石油,而石油产量也大致如此。人们呆在家里,工厂关闭,导致对石油的需求下降了至少2500万桶。所以有2500万桶的产能过剩,这导致利润下降,而石油的消耗是不够的。

Now, oil producers have probably reduced through OPEC, which is this group of countries that cut production by 10 million barrels, so it"s still wildly out of balance. And now people are reducing even more oil and gas so that price will stay low for quite a while. They"re the biggest losers.

现在,石油生产国可能已经通过OPEC减少了1000万桶的石油产量,但是它仍然严重失衡。现在人们近一步减少使用石油和天然气,所以价格将在相当长的一段时间内保持在低位。他们是最大的输家。

In other places like hotels, people haven"t been traveling as much and have been much lower in occupancy. People haven"t gone to leisure time activities like going to movie theaters because they"re scared that the person sitting next to them won"t do so well and it could affect them. And so you will have this distance seating, but if you can"t see a lot of people in a place, that organization won"t make much money. In fact, they might lose money.

在其他领域,比如酒店,人们旅行的次数少了,入住率也低了很多。人们没有进行看电影这样的室内休闲活动,因为他们害怕坐在他们旁边的人不会保护得那么好,这可能会感染他们。所以会有保持距离就坐,但是如果在一个地方没有很多人,这个组织就赚不了多少钱。事实上,他们可能会赔钱。

And it"s the same for restaurants. People like to go to restaurants all over the world, but if you have to only use half of a restaurant because of distance seating, they’ll be hurt.

餐饮业也是如此,世界各地的人们都喜欢去餐馆吃饭,但如果因为保持距离就坐只能使用半个餐馆,盈利会大幅减少。

So there are a variety of businesses that will have difficulty and in particular, retail.

因此,很多企业都将面临困难,尤其是零售业。

As you know, in China, there"s a huge amount of ordering on the Internet and delivery to your homes. What we"re finding around the world is this is putting enormous pressure on shopping malls because retailers are going out of business and they can"t pay the rent. So there’s a whole complex of industries that will be hurt.

在中国,有大量的网上订购和送货上门。我们在世界各地发现,这给购物中心带来了巨大的压力,因为零售商们无力支付房租而面临倒闭。因此,整个行业都会受到影响。

On the other hand, the healthcare business – there"s something developing now called telemedicine so instead of going to see a doctor, you can do the doctor on your iPhone or your Xiaomi phone. And you"ll just have your medical appointment there. If you need to go to a hospital or a laboratory for tests, then you"ll go, but a lot of treatment will be recommended by doctors.

另一方面,在医疗保健行业,现在正在发展一种叫做远程医疗的新事物。不用去医院,你可以在你的iPhone或小米手机上就医。你就可以随时和医生预约。如果你需要去医院或实验室做检查,那你再去医院。但医生可以推荐多种治疗方法。

There will be all kinds of opportunities in the greater healthcare space. There"ll be continual innovations in computer science and the way that technology generally will be applied. So it"s very exciting areas for expansion and for younger entrepreneurs. And then there"ll be some that will be tough.

在更大的医疗领域,将会有各种各样的机会。计算机科学和技术的应用方式将会不断创新,这是一个非常令人兴奋的领域,对于年轻的企业家来说也是如此,当然无可避免也会有一些挑战。

新兴经济体复苏难上加难 现在抄底为时尚早

Question: Except for China and Iran, COVID-19 has yet to hit most emerging market economies to the extent it has impacted Europe and the US. Will it trigger new emerging market crisis?

问:除了中国和伊朗,新冠疫情对大多数新兴市场经济体的影响尚未达到其对欧洲和美国的程度。这是否会引发新的新兴市场危机?

With the emerging markets countries, there are some very interesting things that one would expect to happen.

在新兴市场国家,会有一些非常有趣的事情会发生。

Those countries sometimes borrow in very hard currency. And if their economies get weak because the world goes into recession, it"s going to be really hard for them because a lot of those emerging markets countries, not all but a lot, sell raw materials to countries like China, where China needs those natural resources to power their economy.

这些国家有时会借入“硬通货”,但如果世界经济衰退导致这些国家经济疲软,对他们经济而言将是雪上加霜。因为许多新兴市场国家,将原材料卖给像中国这样需要自然资源推动经济发展的国家。

If countries around the world are growing much, much slower, then it makes it very difficult for an emerging markets country. And if they own money in hard currency that they borrowed, their own currency will get weaker as a result of weak economies. And so it should be a tough time for emerging markets’ economies.

如果全球经济增长越来越缓慢,那么新兴市场国家就会变得越来越困难。如果他们以硬通货形式持有借来的钱,他们自己的货币就会因为经济疲软而贬值。因此,对新兴市场经济体来说,这应该是一段艰难的时期。

Interestingly, some of those economies aren"t having much problem with COVID-19 and nobody knows why. And others, for example, like Brazil, are having major issues, but countries like Myanmar or Cambodia, they"re hardly having any.

有趣的是,新冠疫情对其中一些经济体没有产生太大影响,没人知道原因。而其他国家,比如巴西,正面临严重问题,但像缅甸或柬埔寨这样的国家,几乎没有任何影响。

And this varies around the world much more than with the more mature countries like China, US and Europe, Singapore, Australia. So I think we have to see whether there"s a COVID problem across the board for the emerging markets like there has been for the developed world.

与中国、美国、欧洲、新加坡和澳大利亚等更成熟的经济体普遍受到伤害相比,病毒的影响在世界各国分化严重。因此,我认为应该做进一步分析,判断新兴市场是否像发达国家一样,存在一个普遍的问题。

Question: In a post-pandemic economy, do you expect to see more capital flow into the emerging market economies such as China? Or to more mature markets, such as the US and Europe?

问:病毒大流行后的经济,您预期是否会有更多资本流入中国等新兴市场经济体?或者是更成熟的市场,如美国和欧洲?

China is very interesting because it"s not really an emerging market economy. It"s emerged. Everybody in the world knows, China has emerged.

中国是非常有趣的,因为它不是一个真正的新兴市场经济体,它已经是成熟经济体了,世人几乎都认为中国已经是成熟经济体了。

For most emerging markets economies, it will be some time before they find a bottom where you"ll really want to put money because they become very dependent on their exports to the developing world, including China. And to the extent that the recovery is real fast, then it"s doubly hard for these emerging markets economies. So you can make a mistake of being too early in terms of investing in those areas.

对大多数新兴市场经济体来说,经济还需要一段时间才会触底反弹。因为它们依赖对包括中国在内的发展中国家的出口。即使疫情拐点很快到来,对于这些新兴市场经济体而言,经济复苏也是难上加难,所以不要急于抄底新兴经济体。

中国的亿万富翁比世界上任何地方都多:因为努力和坚持

Question: You just launched your book in China – What It Takes. What do you hope people will learn from reading it? In what ways is it applicable to the current environment?

问:你刚刚在中国推出了自己的新书《苏世民: 我的经验与教训》。你希望人们从中学到什么?它在当前环境中有哪些适用方式?

Well, in terms of my book, I"m really happy. It"s getting a great reception in China because it was written for people who are like the Chinese, written for people all around the world, but they have to be people who are motivated. People who want to improve themselves. People who want to do things. People who want to make things better or more efficient. People with a vision. People who aren"t scared to start new things when they’re completely new like entrepreneurs or there are new things within a company, new products, new areas, new geographies, anything where you"re trying to make something better would benefit from What It Takes, my book.

我很高兴谈到我的新书,这本书在中国很受欢迎,我为全世界各地有能量的人而写,像很多中国朋友一样,他们是想要提升自我的人,是想要建功立业的人,是追求完美、日臻成熟的人,是心怀愿景的人,是像开拓者一样不畏艰险的人,或是正在接触新事物、新产品、新领域、新坐标的人,任何想要追求卓越的人或许都会从我的书中受益。

It"s very good coming out of an unfortunate economic time because people become overly cautious. They become somewhat timid. And it"s at a time like that where you have to look around and say objectively, where are things happening? What should I be doing? What will work in this new world? And you have to think carefully, because in the book I describe only so many things you can do.

对于此刻这个经济低迷时期而言,这本书是非常有益的。人们变得小心谨慎甚至有些胆怯,环顾四周思考事情是如何发生的?我又该怎么做?未来什么会主导这个新的世界里?而我在书中讲述了很多可选择的方案。

There are some remarkable and amazing Chinese companies that have just been created, some in the last five years, some in the last 10 years, or an old company in China. Could be 20 years old. So people have created these remarkable companies with a vision and drive. And one of the great things about China is that people work at least as hard as any other place in the world, and they do it for a sustained period of time. So if you have a great idea and you figured out how to do it and you have a certain amount of charm where you can attract capital, you can create something wonderful.

中国有一些非常优秀的企业,无论是刚刚成立或者已经经营5年、10年甚至超20年的,人们用远见卓识和非凡动力创建了这些伟大的公司,人们能够非常努力工作且坚持不懈,这是中国能屡创奇迹的原因之一。所以,如果你有一个绝妙的想法并且知道如何付诸实践,你就一定有魅力可以吸引资本,可以创造出一些很美妙的奇迹。

Remember, there are more billionaires in China than any other place in the world. And 40 years ago, the average person had an income of only $300 a year, which I guess now is somewhere around 2,000 yuan a year. To have more billionaires than any other country.

40年前,中国的人均年收入只有300美元,大概是人民币2000元左右。而现在,拥有比其他任何国家都多的亿万富翁。

And so this book will help you find your way at a time where a lot of people are uncertain and tentative. So here it is. If I were you, I would buy it. And I would read it. It"s actually quite funny, which most people find surprising. It"s like a thriller. It reads very quickly. So people tend to recommend it.

这本书将帮助你在不确定和犹豫时找到方向,如果我是你,我会购买并阅读它。令很多人感到惊讶的是,这其实是一本很有趣的书,像惊悚片一样引人入胜,所以读起来很快。

If you"re somebody my age, you’d recommend it to your children. If you"re my children"s age, they’d recommend it to their children because everybody learns and somebody has to be a teacher.

如果你是我这个年纪的人,你会把它推荐给你的孩子。如果你是我孩子的年龄,你会推荐给你的孩子,因为每个人都会从中学习,总有人要当老师。

I wrote the book so that I could help people avoid the mistakes that I"ve made in my career. Nobody gets it all right. It doesn"t work that way, whether it"s me or you. The key is how you learn from those mistakes and relaunch or change what you"re doing.

我写这本书是为了帮助人们避免我在职业生涯中所犯的错误。没有人不会犯错。人生不是一帆风顺的,无论是我还是你。关键是你如何从这些错误中吸取教训,重新开始或做出改变。

And so I recommend the book to you. It took me a long time to write it. I"m pleased with it and I"m glad it"s been so well accepted in China.

所以我向你们推荐这本书,写这本书花了我很长时间。我对它很满意,我也很高兴它在中国也广受好评。

专题:全球经济走出至暗时刻的秘密,就在这些人的演讲当中

1.《华尔街体 凤凰独家|华尔街私募之王警告:新兴经济体复苏难上加难 现在抄底为时过早》援引自互联网,旨在传递更多网络信息知识,仅代表作者本人观点,与本网站无关,侵删请联系页脚下方联系方式。

2.《华尔街体 凤凰独家|华尔街私募之王警告:新兴经济体复苏难上加难 现在抄底为时过早》仅供读者参考,本网站未对该内容进行证实,对其原创性、真实性、完整性、及时性不作任何保证。

3.文章转载时请保留本站内容来源地址,https://www.lu-xu.com/caijing/492847.html